Sitaraman holds the 48th GST Council meeting, and the panel agrees to decriminalize certain offenses, doubling the limit for launching prosecution.

What is the GST council?

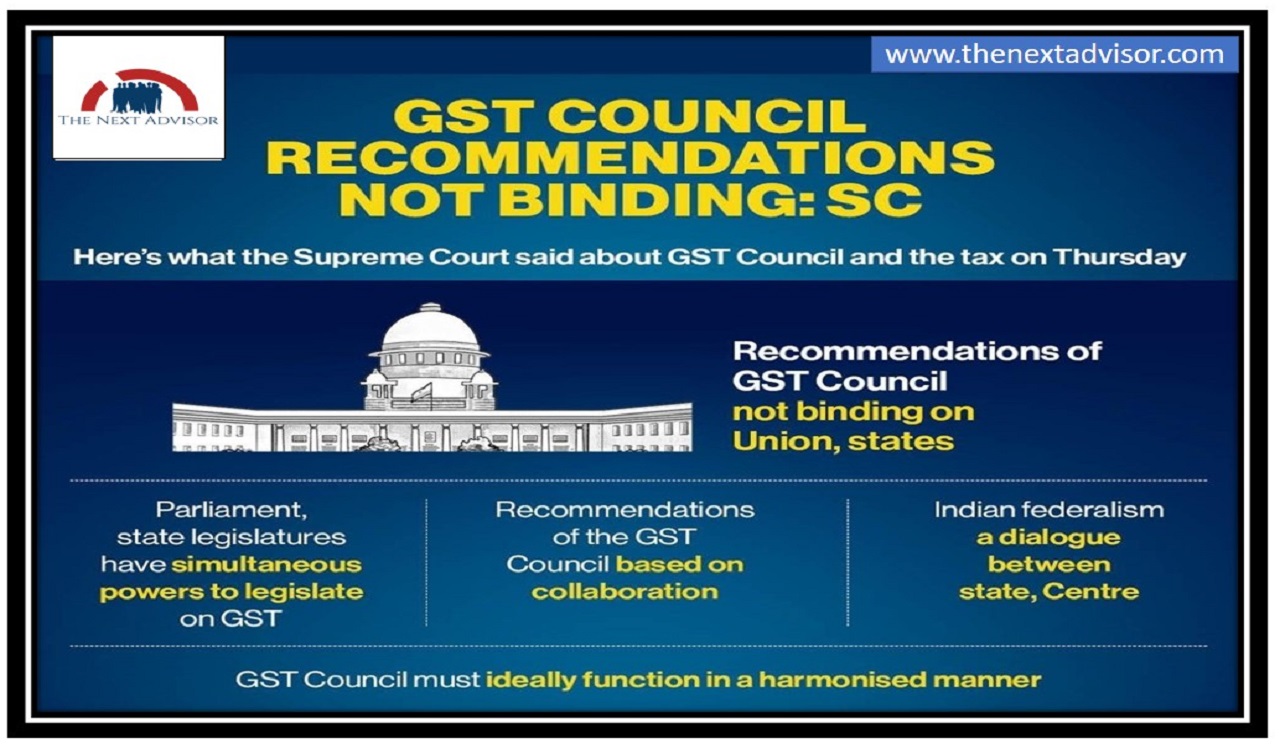

The good and services Tax council is a constitutional body under Article 279. headed by the union finance minister and has the union minister of state for finance and the finance ministers or any other ministers appointed from the state governments as members. The supreme court made it clear that the council is only a recommendatory body and its recommendations are not binding on centers or states. What does the GST council do The main task of the council is to make recommendations to the union and the states on important issues related to GST like,

1. The goods and services that may come under the banner of GST.

2. Model GST lows.

3. principles that govern the place of supply.

4. Threshold limits.

5. GST rates including the floor rates with bands.

6. Special rates for raising additional resources during natural calamities.

7. the appointment of goods and services tax levied on supplies in the course of inter-state trade or commerce under article 269A.

How are the decisions taken?

The council must have at least 50% of members present and be able to hold a meeting and make recommendations. The suggestions made by the council need a three-fourth majority of the members present and voting in the meetings.

What has happened?

Finance minister Nirmala Sitharaman virtually chaired the 48th meeting of the goods and services tax council meeting on December 17.

tax changes –

no tax increase on any item was decided at the GST council meeting on Saturday. meanwhile, the council recommended reducing GST on biofuel from 18 percent to 5 percent. Incentives paid to banks by the Central Government under the scheme for the promotion of Rupay Debit Cards and low-value BHIM-UPI transactions are like subsidies and thus not taxable. therefore, clarification was given at the council meeting that the higher rate of compensation cess of 22 percent applies to a motor vehicle fulfilling all four conditions –

1. It is popularly known as SUV.

2. Has engine capacity exceeding, 1,500cc.

4. Has ground clearance of 170 mm and above.