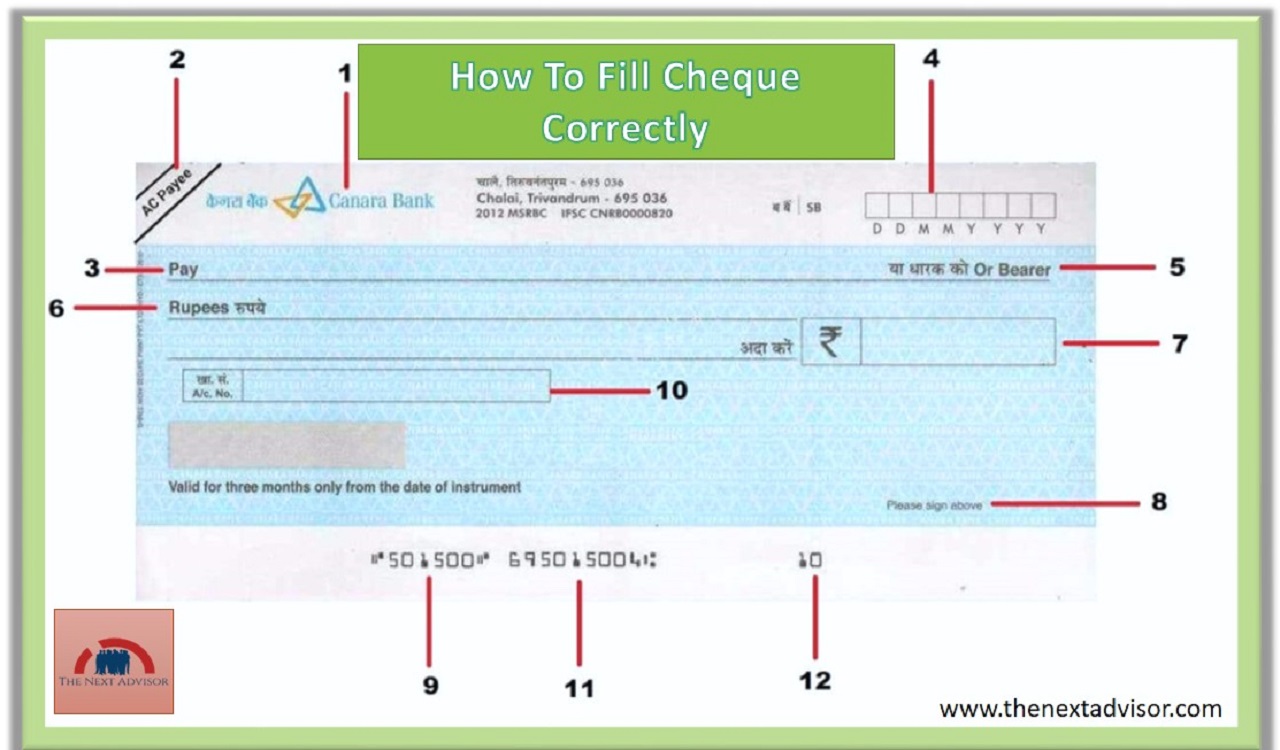

So folks first off here’s a basic thing: How To Fill out Cheque Correctly.

If somebody asks you for a canceled cheque, there’s no need to sign it. And whenever you sign/fills out a cheque, please don’t borrow one.

Use your pen.

Because the person might lend you such a pen with erasable ink. Which has been designed for fraudulent activities. So, before filling in a cheque, let us understand typical parts of the cheque and what they represent. Keep in mind that the cheque is valid for 3 months from the date of signing. Always check whether the cheque was handed over to you. Or the one you are giving is not exceeding the limit.is not invalid. Remember-never to leave any kind of space while writing the name, or else it can be easily changed by inserting even a single letter.

Also, don’t leave too much space between the first name and the last name, it can be tampered with. Write the digits/numbers from the very start of the provided box without leaving any gaps in between. Suppose while signing the cheque, you feel that you’ve not done it properly/there has been some mistake, you can do your correct signature beside it. Towards the bottom of the cheque, there are two numbers you’ll need to keep in mind. The first is the cheque number’ and the second one is ‘The MICR number’.

These two numbers are going to be helpful to you. On the backside of the cheque, the name and account number of the person/school/account to which you’re issuing the cheque, So that even if the cheque attached to the slip book is misplaced, it will be issued to the correct account. While mentioning the payee, you also can find ‘ or bearer’ written next to it. If you wish that only and only the payee should collect the cheque, you can strike off’ or bearer’. If you wish the cheque to be directly deposited in a bank, and nobody else should be able to withdraw money using it, you can cross the cheque and write A/C payee.

Such a cheque would be directly deposited in the bank. ones cannot withdraw money from a bank using this cheque. Folks, it’s a good practice to keep a record of each cheque that you issue on the slip provided in the checkbook, by mentioning the date, cheque no., name of the recipient, and the amount. So that you can mention it in your tally or accounts someday later without fail. Banks generally issue cheque booklets that have either 25 or 50 leaves and if you are somebody who frequently issues cheques.

In this case, it would be feasible to issue 3-4 checkbooks at a time, which may contain 150-200 cheques. you can have a bound copy of these cheques in a way that a blank page follows every cheque. Whenever you are issuing a cheque, keep a carbon paper in between the cheque and the following blank page, and then fill the cheque, This will be a detailed record of the cheque you issued. One more thing you can do while getting checkbooks bound is that you can already fill up the voucher numbers.

The third thing to keep in mind while your accountant or you, are doing entries of these cheques, in Tally or any other software that you use for accounting, you can stamp it as ‘fed’. So that one more step is ensured and your time will be saved yet again. On the cover page of the checkbook, You can mention the account number, bank details, and the IFSC code. After filling out a cheque, an equally important step is to deposit it in the bank. Whenever you fill out a cheque, you mention details on the backside like the name of the party or the company that has issued it.

So, Friends, this was the whole thing you have to be in your mind while that How To Fill Cheque Correctly.