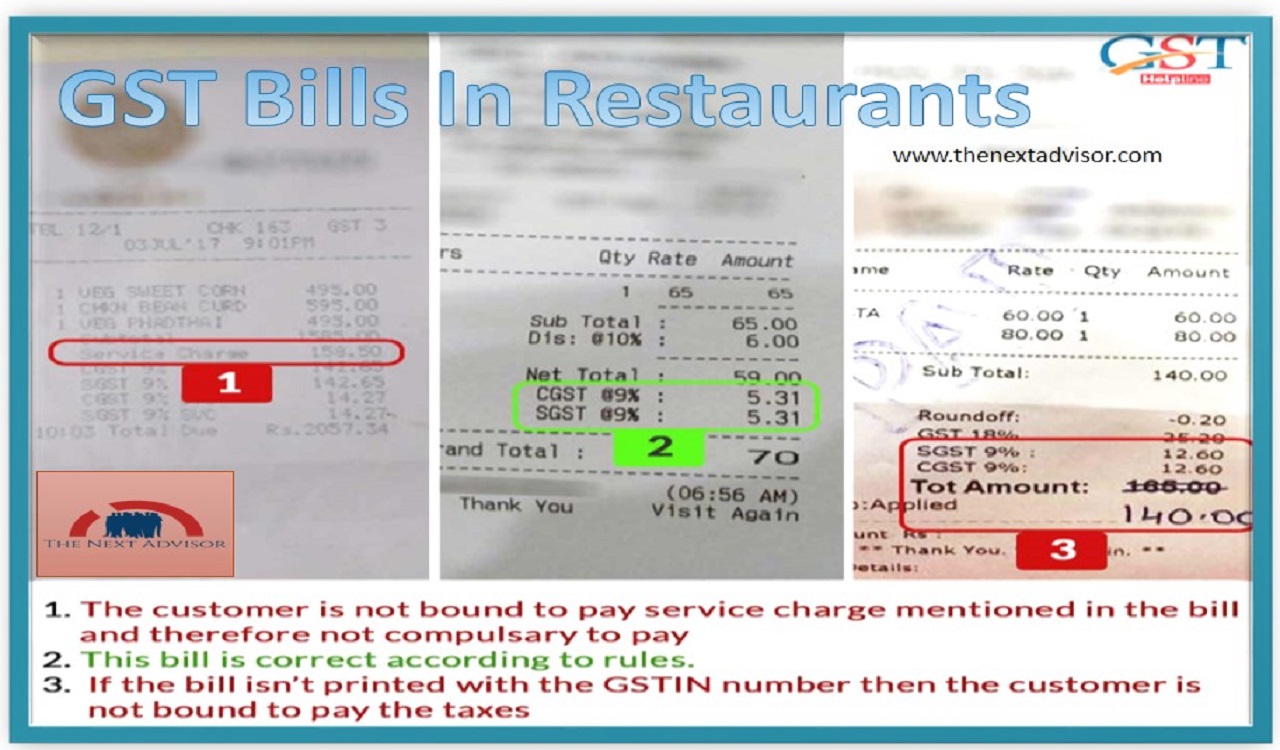

If you buy any item from any shop you must see the GST Bills In Restaurants. If the GST Bills In Restaurants don’t include the printed GST number then your dealer is not registered by GST. If you can’t find the GST number anywhere in your bill, then is not registered with GST. And if still you are been charged with GST tax then it’s a fraud with you.

Secondly, some people print the GST number but it’s a fake number printed by them.

How can you recognize whether the printed GST number is fake or not?

It is possible by visiting a website. https://services.gov.in/services/searchtp. So, you can easily enter this number to see your GST. There is something unique about this GST number that its 6th digit can tell you whether the GST number has been registered by a person or a company.

The third thing you need to notice is how much GST is been charged to you if you are a non-alcoholic service, non-ac restaurant then it should be charged 12%. If you are eating at an AC restaurant or a hotel or any alcohol-serving restaurant then it will be 18% GST charged.

If you are taking food from any takeaway counter, even though it will be 18% charged. At the restaurant, then there is no GST on alcohol.

The fourth thing my friends is the service charge. It is not a tax. No one can force you for that.

So, through these 3-4 ways you will get to know that you have been targeted with GST fraud.

Now, let’s talk about how to complain about such GST fraud.

There are 5 different ways to complain about it.

The first one is, that you can call this number – 1800114000.

The second way is to complain on this website – https://consumerhelpline.gov.in.

The third way is to write an email to – Email: consumer-helpline@giv.in.

The fourth way that you can complain is at the GST portal – Email:helpdesk@gst.gov.in.

The fifth way is that you can contact them through Twitter.

So, these are the Twitter handles which you can contact @ jagorahakjago, @consaff.

These are some of the ways you complain about GST fraud. If the GST fraud is caught.

Then, there is a fine of 100% of the tax amount. Or up to 5 years of jail.